Key Takeaways

- Datafication of Physical Assets: The Internet of Things (IoT) is fundamentally about converting the physical world into analyzable data, enabling real-time monitoring, management, and optimization of operations at scale.

- Widespread Industry Disruption: Seven key industries including manufacturing, automotive, healthcare, and logistics are undergoing significant transformation, shifting from product-centric models to data-driven services.

- Massive Market Growth: The global IoT market is projected to exceed $1 trillion by 2025, with enterprise spending growing rapidly. This growth fuels innovation but also introduces significant security risks that must be managed.

- The AI and Cloud Flywheel: When combined with AI and cloud computing, IoT’s value is amplified, creating a virtuous cycle where more data leads to better automated decisions, tighter operational control, and new revenue streams.

Table of Contents

Introduction

Here’s the deal: the Internet of Things isn’t just gadgets. It’s how we turn the physical world into data we can steer. That shift is why we’re seeing entire business lines get rewritten.

This piece breaks down seven industries disrupted by IoT, what’s changing right now, and where the money and value are going. And yeah, when you mix IoT with AI and cloud, the flywheel spins faster and the gains stack.

The Disruption Engine

At its core, IoT wires physical assets into digital systems so we can measure, analyze, and tune operations at crazy scale.

Proof

- Products become ongoing services with usage data and updates.

- Maintenance shifts from “fix it when it breaks” to “fix it before it breaks.”

- Estimates give way to live dashboards and real-time decisions.

For example, a shipping container that pings its location and internal temperature turns a mystery into a managed flow with fewer surprises.

By the way, this isn’t small. The global IoT market is tracking toward $1.06 trillion by 2025. In 2023, we had 16.7 billion active endpoints, and 2024 hit 18.8 billion, up 13%. That kind of scale explains why we’re seeing so many industries disrupted by IoT.

1) Manufacturing: The Self-Optimizing Factory

Let’s start where the dollars are heavy. Industrial IoT (IIoT) could reach $275.7 billion by 2025 and as high as $399 billion in 2026, at 14.5% growth. Some forecasts peg the economic upside at $14.2 trillion by 2030. In the U.S., 2023 sat at $66.28 billion, with 11.5% CAGR on deck. And yes, 80% of manufacturing CEOs say supply chain shocks hit them hard.

How IoT changes the game

- Predictive maintenance cuts downtime by spotting trouble early.

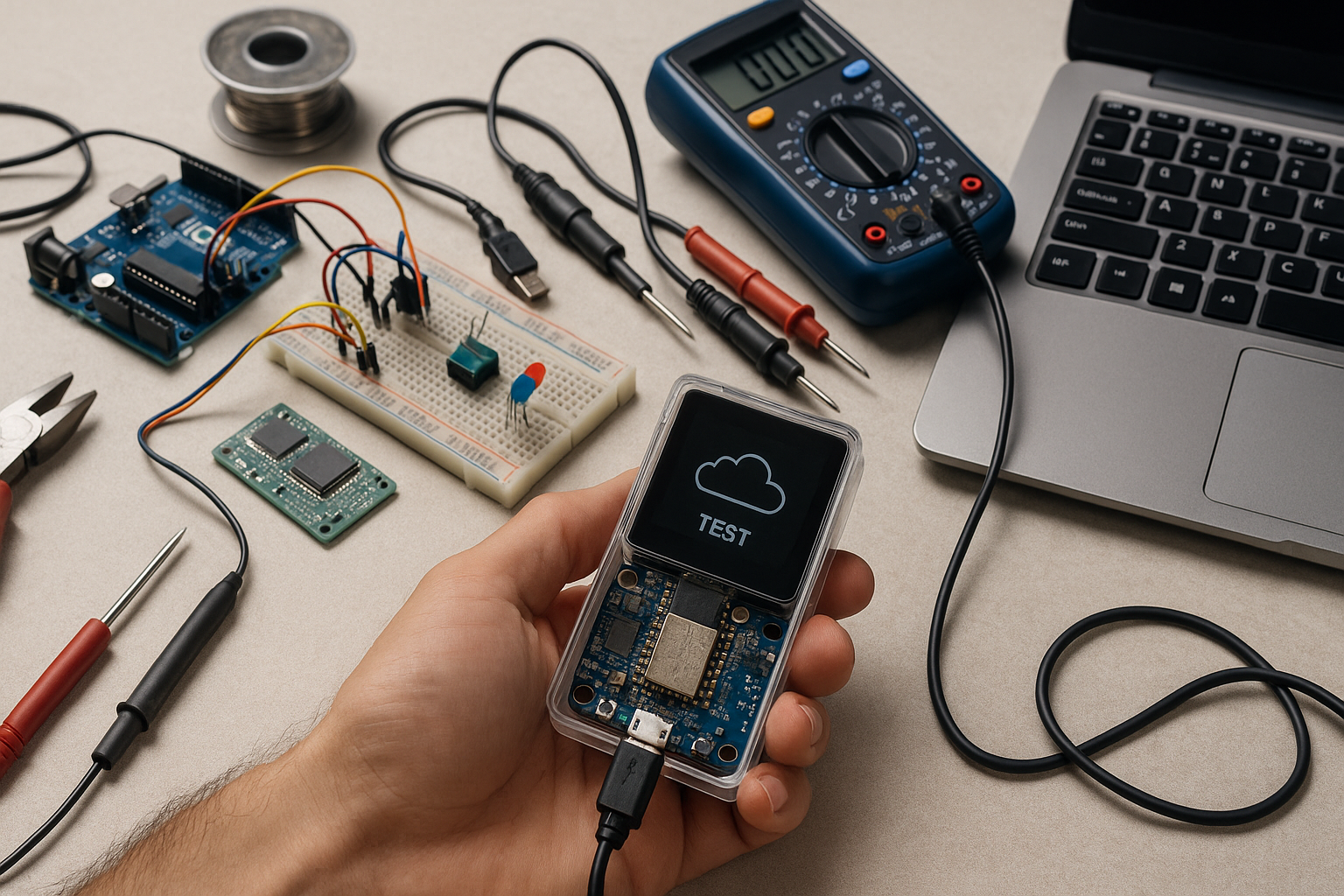

- Digital twins test changes before they hit the floor, a process that benefits from advanced IoT prototyping and device testing.

- Sensors power automated quality checks and tighter yield.

In practice: a CNC spindle starts to vibrate out of spec, so the line slows, a tech swaps a $150 bearing, and the plant avoids a $150,000 outage.

This is one of the biggest industries disrupted by IoT, because it hits cost, uptime, and output all at once. If you track IoT impact or IoT use cases, this is your first stop.

2) Automotive: From Connected to Autonomous

Back in 2020, the IoT auto market clocked $47 billion. By 2027, forecasts say $227.7 billion at 25.2% CAGR. The connected vehicle market is aiming at $541.7 billion by 2025 with 16.4% growth. That’s not just dashboards. That’s telematics, safety, fleet savings, and the path to autonomy.

What changes on the road

- Cars talk to the cloud for diagnostics, updates, and safety alerts.

- Fleets mine data for fuel, routing, and driver coaching.

- Vehicle-to-vehicle comms shrink reaction time and reduce accidents.

Picture this: a car senses black ice at mile marker 118, pushes a warning to nearby vehicles, and the convoy slows before anyone spins out. It’s another clear case of industries disrupted by IoT in real life.

3) Healthcare: From Sick Care to Always-On Care

Healthcare is going from checkups to continuous. Market value could hit $534.3 billion by 2025. That growth rides on remote monitoring, wearables, connected devices, and telehealth.

Where the shift shows up

- Remote patient monitoring cuts readmissions for chronic care.

- Wearables track vitals 24/7 and flag trends early.

- Connected assets find equipment faster and reduce losses.

A simple example: a smart inhaler logs usage and local air data. The doctor sees a pattern, adjusts meds, and prevents an asthma flare before it sends a patient to the ER. Among all industries disrupted by IoT, this one directly touches lives every single day.

4) Logistics & Supply Chain: The End of the Black Box

Supply chains hate blind spots. IoT shines a light. Thousands of assets report location and condition in real time, which trims loss and tightens inventory. Predictive maintenance on trucks and equipment protects uptime. Route optimization alone can save millions per year, a key part of enterprise workflow optimization.

Proof on the ground

- Live fleet tracking reduces idle time and improves on-time rates.

- Cargo sensors catch temperature, shock, and tamper events.

- Smart warehouses count, place, and reorder with fewer misses.

Say a vaccine shipment crosses a 46°F threshold. The crate pings the ops team at 2:14 PM, they reroute in 5 minutes, and the batch stays viable. No drama, just math. If you’re mapping industries disrupted by IoT, this one has fast payback.

5) Energy & Utilities: The Intelligent Grid

Utilities are rolling out smart meters and grid sensors at scale. That sits inside the broader IIoT market heading toward $275.7 billion by 2025. The payoffs are real: fewer outages, better demand planning, and lower spend.

What’s changing on the grid

- Smart meters feed live consumption to both the utility and the customer.

- Sensors localize faults, isolate lines, and speed repairs.

- Demand response shifts load in minutes, balancing spikes.

Imagine a city pulling power from a neighborhood with low load to one peaking at 6:12 PM, dodging a brownout. It’s an example of applied green tech and another clear entry in the list of industries disrupted by IoT, with direct dollars and public wins.

6) Retail: Stores That Think Like Websites

Retailers don’t guess as much now. By 2025, billions of sensors sit across stores, shelves, and supply chains. The payoff shows up in lower shrink, fewer stockouts, and better demand signals.

Where it shows up in-store

- Smart shelves track item counts and trigger reorders at the right time.

- Beacons and apps tailor offers to in-aisle shoppers.

- Cashier-less checkout trims lines and boosts conversion.

Picture a shopper walking in at 5:32 PM. Their app pings a 15% coupon for the skillet they viewed online on Tuesday. The sensor grid guides them to Aisle 7. That’s how retail joins the set of industries disrupted by IoT while blending online and offline.

7) Smart Homes & Consumer Electronics: Daily Touchpoints

We’re swimming in devices at home. By 2025, global IoT devices could top 18 billion, with some forecasts pointing to 39 billion. At the same time, 36% of firms say they’re trying new IoT directions, which spills into appliances, wearables, and home security.

Where you feel it

- Thermostats trim bills by learning real patterns, not guesses.

- Security systems stream events and call help in seconds.

- Health trackers nudge better sleep, steps, and recovery scores.

A simple scene: your thermostat learns weekday vs. weekend, drops usage by 12%, and your utility plan prices in real-time data. That’s yet another proof point in the pile of industries disrupted by IoT, one you notice every single morning.

Market Scale, Spend, and Risk You Shouldn’t Ignore

Let’s put a few more numbers on the board. Enterprise IoT spend jumped from $159 billion in 2021 toward $412 billion in 2025 at roughly 26.7% CAGR. Many teams already put around 7% of IT budgets into IoT, and they’re pushing toward 10% soon. On the risk side, daily attacks on IoT devices could hit 820,000 in 2025. In healthcare, a single IoMT breach can cost up to $10 million. OT ransomware is up 46% in recent years. Device risk scores rose 33% since 2020, landing near 9.1 in 2025. So yeah, the upside is big, and the defense plan matters.

The Next Aggregation

Here’s the throughline across all the industries disrupted by IoT:

- Companies move from selling products to selling steady, data-backed outcomes and services.

- Revenue blends one-time sales with subscriptions, usage fees, and performance guarantees.

- Operations run on live data, not monthly reports.

What could slow the next wave

- Security and safety across billions of endpoints.

- Interoperability between vendors, devices, and clouds.

- Data privacy, ownership, and clean governance.

So where does this go next? As more industries disrupted by IoT stack data, AI turns those streams into better decisions in seconds, not days. The real story isn’t the “things.” It’s the new business models, the tighter loops, and the compounding gains from Internet of Things in business that define the future of IoT. If you care about IoT industry disruption and IoT transformation, now’s the time to pick your spots and move.

IoT Disruption Quick Facts Table

| Category | Data Point |

|---|---|

| Global Market Size (2025 est.) | $1.06 trillion |

| Active Endpoints (2024) | 18.8 billion |

| Industrial IoT (IIoT) Market (2025 est.) | $275.7 billion |

| Enterprise Spend CAGR (2021-2025) | 26.7% |

Industry Disruption Impact Comparison

| Industry Vertical | Key IoT Application | Primary ROI Driver |

|---|---|---|

| Manufacturing | Predictive Maintenance | Downtime Reduction |

| Automotive | Fleet Telematics | Fuel & Route Optimization |

| Healthcare | Remote Patient Monitoring | Reduced Readmissions |

| Logistics | Real-time Asset Tracking | Loss Prevention |

| Retail | Smart Shelves | Inventory Optimization |

FAQ

What is the main benefit of IoT for businesses?

The main benefit is turning physical assets into digital systems. This allows businesses to measure, analyze, and optimize operations in real time, which improves efficiency, creates new data-driven services, and shifts maintenance from reactive to proactive.

Which industry has the largest economic potential from IoT?

Manufacturing, via the Industrial IoT (IIoT), has the largest projected economic potential. Some forecasts estimate an economic upside of over $14 trillion by 2030, driven by gains in predictive maintenance, automated quality control, and operational uptime.

What are the biggest risks associated with IoT adoption?

The biggest risks are security, interoperability, and data privacy. Securing billions of endpoints from cyberattacks is a major challenge, as is ensuring that devices from different vendors can work together. Strong data governance is also critical to manage privacy and ownership issues.